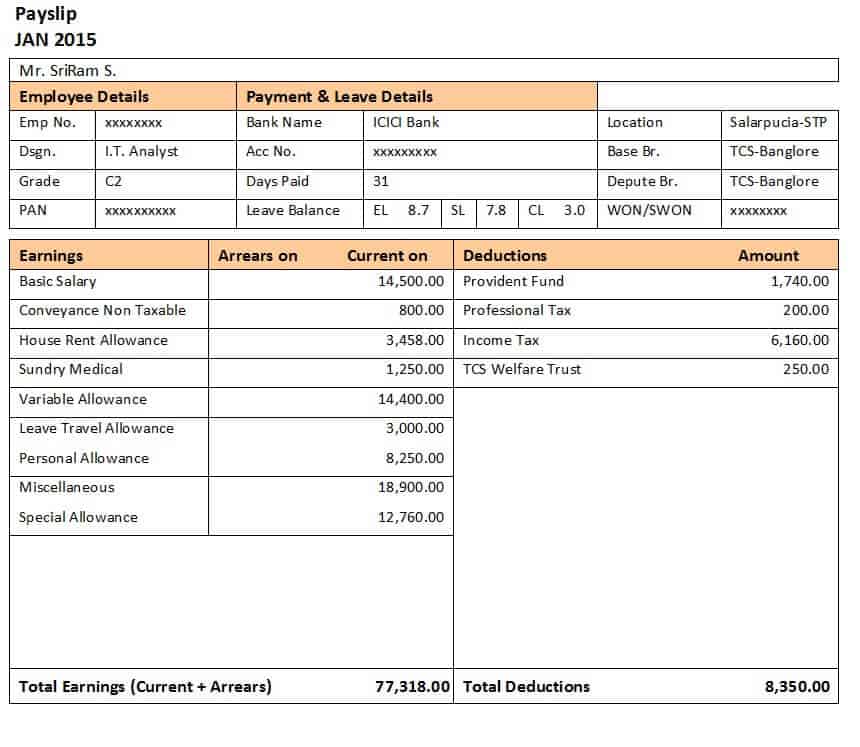

It also includes other sources of income like Bonus and Commission. Such allowances are- Children Education Allowance, Transport Allowance, and Car Allowance, Conveyance or Transport Allowance, Overtime Allowance, Leave Travel Allowance (LTA), Performance Bonus.

During tax calculations, they are taken into account. This amount of money is also added with Basic Salary and DA. Medical Allowance: A) A certain percentage of money is provided to the employees as a medical allowance.DA is added to the basic salary as per the percentage. A certain percentage is allotted upon which the following calculation is done. It is an important element in tax calculation. The main motive behind it is to reduce the effect of inflation on workers. It is provided to the government employees. Dearness Allowance (DA): Payslip term it as DA.It is the base of payslip and other Salary components are determined on this basis of this. On the basis of the basic salary, further calculations are done. This is the major element of the income as it comprises out about 40% of salary. Basic Salary: Basic salary can also be termed as the principal amount.Nowadays, the document is often sent via e-mail, but before, the slip was handed over manually.ĬOMPONENTS OF CALCULATION OF GROSS INCOME OR GROSS SALARY

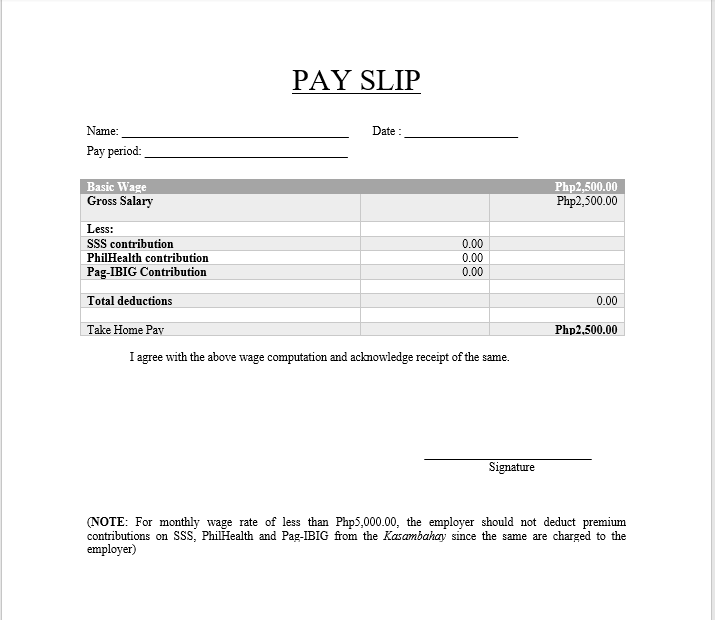

It is usually issued after the monetary value is transferred to the bank account. No matter of headcount, a company has to provide a salary certificate or slip to every employee. A payroll slip is documented proof of the amount paid by the employer or the organization’s head. It is evidence of the payment of salaries and wages to the workers.

SALARY SLIP FORMAT HOW TO

How To Create A Standard /Basic Salary Slip Excel Templates? What is the Significance of Salary Slips?.

0 kommentar(er)

0 kommentar(er)